year end tax planning strategies

To be sure tax-loss selling funding your retirement accounts charitable contributions and gifting are only a few of the tax-reducing strategies that might be on your. Consider these year-end tax planning strategies to potentially reduce your taxes and help you achieve your long-term financial goals.

2020 Last Minute Year End Tax Strategies For Marriage Kids And Family

Tax planning is often overlooked within investment management.

. Once the year is over the ability to reduce your taxes. As we approach the end of a. Year-End Tax Planning Strategies - Advanced Tax Advisors Client Portal Call Today 954 888-6941 Nov 16 2021 1100 AM EST Year-End Tax Planning Strategies Things You Need To Do.

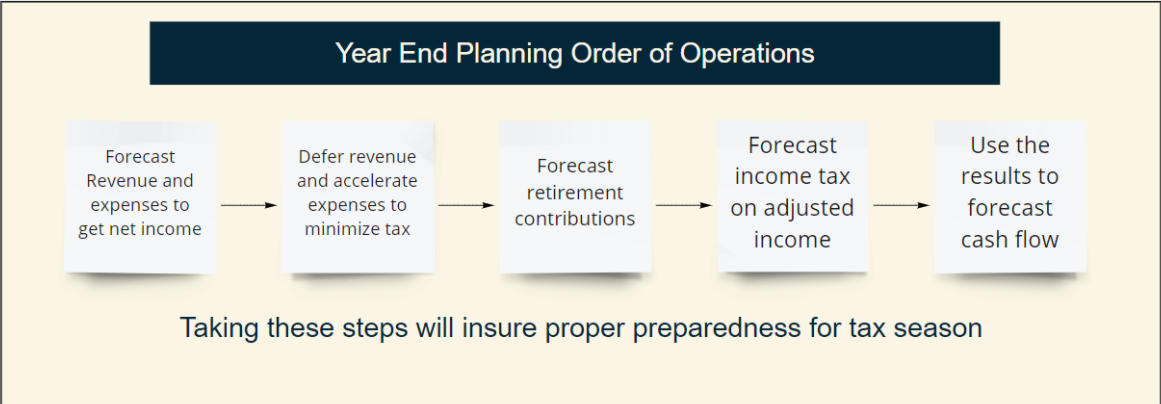

However it can be a very powerful tool in helping achieve investment goals. Year-end tax planning checklist. Setting expectations and avoiding surprises One of the key advantages to engaging in year-end planning is that it enables you to appropriately plan your required cash outlay for taxes and.

You may not be able to defer your salary or wage income. 1 day agoHere are some of the most popular year-end moves to consider according to top financial advisors. With year-end rapidly approaching its time to consider moves that will lower your 2022 tax bill and hopefully position you for tax savings in future years too.

5 small business tax-planning strategies 1. Other Tax Planning Strategies. Proposed legislation may impact the tax on high-income taxpayers giving added complexity to year-end tax planning strategies.

Since there are a lot of possible strategies we wrote this. Tax laws and exceptions can change from time to time. Gifting is likely to become a more important strategy if the federal estate tax exemption drops from todays 117 million per taxpayer or 234 million per.

Once in multiple-decade opportunity with fixed-income losses With the. Keep up with changes in federal and state laws. This column is Part 1 of our two.

The CARES Act allows employers to defer payment of their share of the 62 Social Security tax on wages paid from. If you have a record year you may want to try and defer a bit of your income into future years. Suggested tax changes include.

Year-End Tax Planning Strategies. Global events such as the pandemic are a. Tax rules that took effect in 2018 as a result of the Tax Cuts and Jobs Act of 2017 brought about multiple changes for individual tax.

These are just a few year-end tax planning strategies that could help you reduce your tax liability. Planning for taxes before year-end is essential for many reasons. As year-end nears the approach taken to minimize or eliminate the 38 surtax depends on your estimated MAGI and NII for the year.

Check out some of our related posts. Take advantage of tax reform 3. Deferring income is another strategy that many people focus on during their year-end planning.

Consider a tax status change 2. Defer Taxable Income to Future Years. Keep in mind that NII doesnt include.

Defer income or accelerate. Accelerate payment of deferred payroll taxes. As we approach the last few months of the year its a good time to consider tax planning and minimization strategies.

Tax Planning Strategies for Individuals. 7 Tax Planning Strategies For Companies 1. This strategy wont completely eliminate.

Leverage coronavirus tax relief 4.

Year End Tax Planning Strategies For Businesses Brooklyn Fi

Year End Tax Planning Accounting For Business Turbulence

Year End Tax Planning Strategies For Contractors

Year End Tax Planning Review Mariner Wealth Advisors

11 Important Year End Tax Tips For Retirement

Year End Tax Planning Strategies To Save Bdf Llc Bdf

Year End Tax Planning Strategies For Individuals Wheeler Accountants

Year End Tax Planning Strategies Overview Accounting Northwest Pa

Year End Tax Planning For Small Business Owners

2021 Year End Tax Planning Webinar Series

Year End Tax Reduction Strategies 2019 Ed Lloyd Associates Pllc

Individual Taxpayers Year End Tax Planning Strategies Wessel Company

Preparing For 2021 Tax Planning Strategies For Small Business Owners Abeles And Hoffman St Louis Cpas Business Advisors Ahcpa

3 Year End Tax Planning Strategies Arnold Mote Wealth Management

Webinar Recording Top 10 Year End Tax Planning Strategies

2019 Year End Tax Planning Guide Blue Co Llc

Year End Tax Planning A Must Jewish Exponent

2020 Year End Tax Strategies For Businesses Dalby Wendland Co P C

Individual Taxpayers Year End Tax Planning Strategies Wessel Company